What is Cash Damming? Cash Damming offers the potential tax deductions for rental properties

Common mistakes and strategic wins for rookie investors

Common mistakes and strategic wins for rookie investors.

What is an insured mortgage?

What is an insured mortgage? An insured mortgage is when there is less than 20% down payment

Are You Ready to Get Out of Debt?

Debt is something most Canadians carry. Getting out of debt provides both financial and emotional relief so eliminating the debt allows a fresh start. Let’s say you own a home for 7 years and carry 2 credit cards, one for 5,000, one for 11,000, and a line of credit for 22,000. The minimum payments on […]

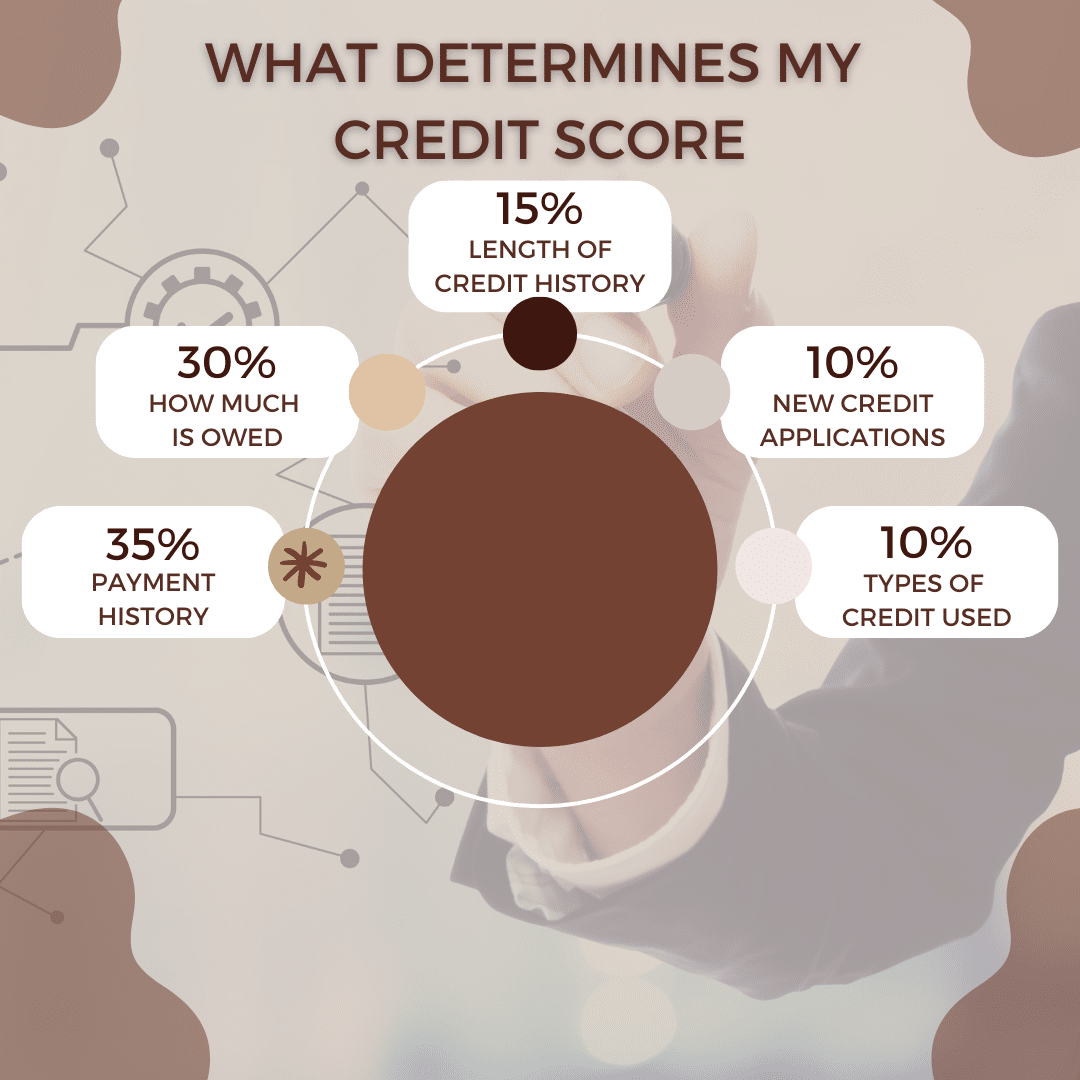

Introduction to Credit Scores

Introduction to Credit Scores As we navigate through life, we make financial decisions that can impact our financial future. From paying bills on time to paying off loans, it all plays a role in our credit score. But what exactly is a credit score, and why is it important? In this article, I will be […]

RESP vs. Rental Property

RESP vs Rental Property, Which is the Better Choice? When it comes to investing, there are many options available. Two of the most popular options are Registered Education Savings Plans (RESPs) and rental property investing. Both of these investments provide the potential for growth and potential for income, but each comes with its own set […]

Reasons To Use a Mortgage Broker

There are many reasons to use a mortgage broker to find the right mortgage product. Shopping for a mortgage can be a stressful and confusing process. From researching lenders, loan types, and interest rates to comparing fees and features, the process can be overwhelming. That’s why it makes sense to use a mortgage broker. A […]

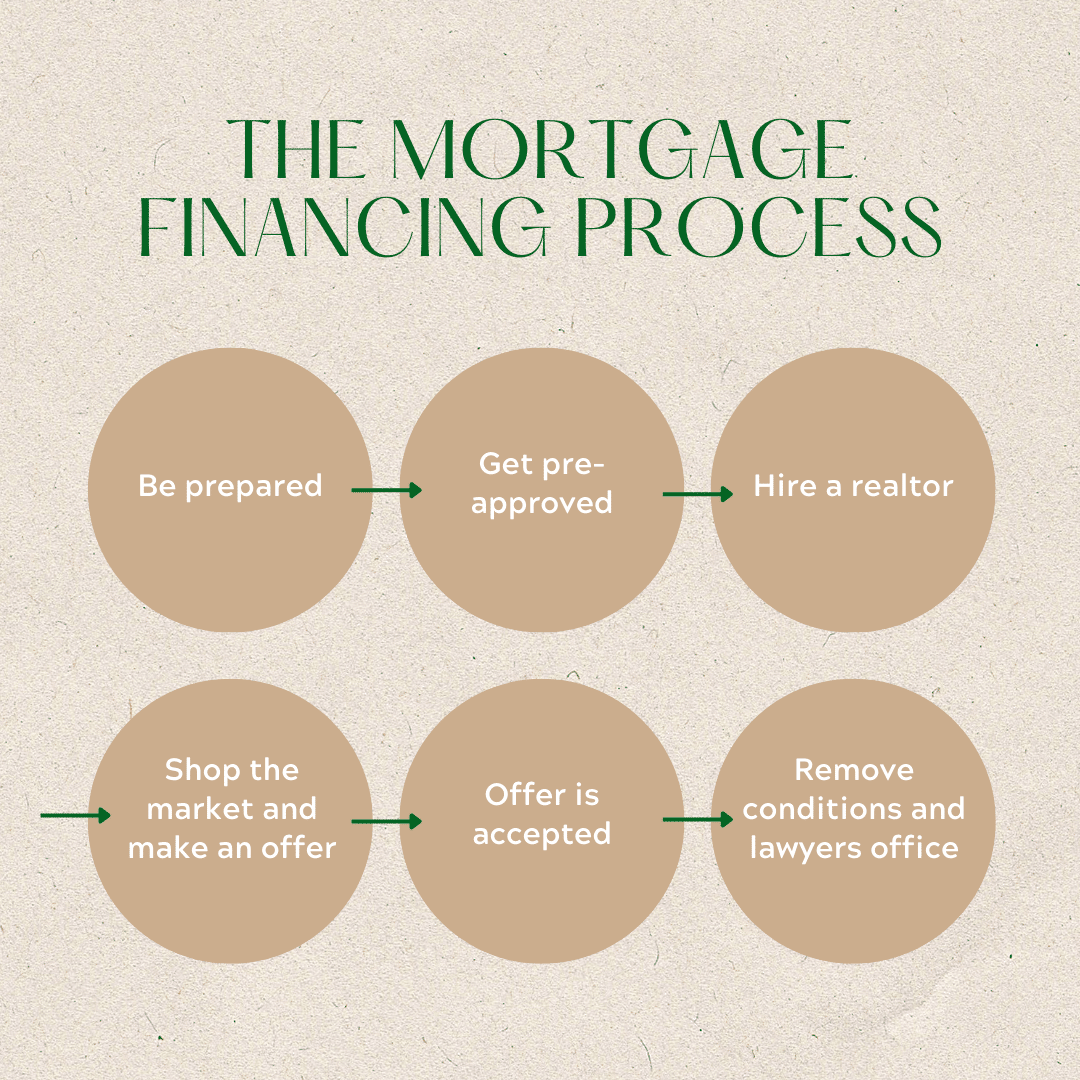

7 Tips to Get Approved for a Mortgage

If homeownership is something that is important to you, our 7 tips to get approved for a mortgage will help you get there. The home-buying process can be stressful but working with the right team can make it much easier. The key is being prepared by getting your finances in order. Here are 7 ways […]

Tax Deductible Mortgage

Are you interested to make your mortgage tax deductible? Debt is pretty much a given; even wealthy people have debt. The difference is that they turn their loans into good debt by making the interest tax-deductible with the help of accountants and lawyers. The Smith Maneuver is a legal tax strategy that effectively makes interest […]

GDS/TDS Ratios Explained

GDS/TDS Ratios Explained When qualifying for a mortgage, lenders look at your debt service ratios. This tells lenders exactly how much you can afford to borrow for a new home purchase. It is a good idea to understand how lenders calculate the maximum amount you can qualify for. The two calculations lenders do is gross […]